In 2026, the manufacturing sector is witnessing a profound shift in how marketing dollars are spent. The era of “spray and pray” at massive trade shows, print catalogs, and distributor-led sales is being replaced by a calculated, digital-first approach that prioritizes measurable lead generation and AI-driven efficiency.

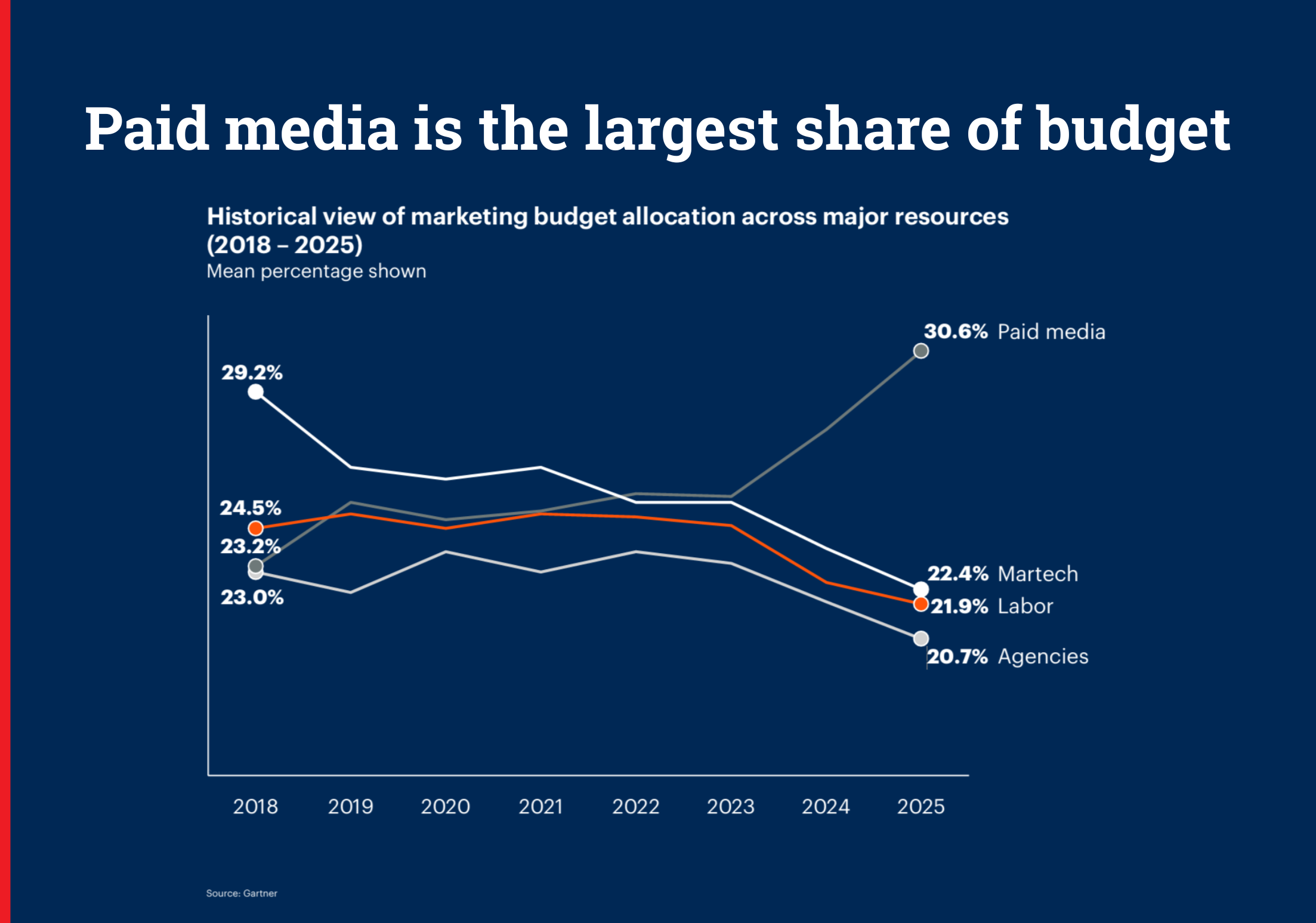

According to the latest benchmarks from Gartner and Forrester, while overall marketing budgets for manufacturers have stabilized at roughly 7-9% of total revenue, the internal allocation of those funds has changed forever.

Here is how manufacturing marketers are allocating budgets in 2026, what is driving these decisions, and which trends are shaping marketing investment across industrial sectors:

The Budget Breakdown: Where the Money is Going

For decades, trade shows were the undisputed kings of the manufacturing budget. Today, they are just one piece of a complex puzzle dominated by measurable digital performance.

Based on the latest Gartner CMO Spend Survey and industry benchmarks, here is the new blueprint for manufacturing marketing budgets.

Digital Spend: The New Majority (61% of Total Budget)

Digital channels now command the lion’s share of the budget. However, not all digital spend is created equal:

- Paid Media (68%): This is the single largest investment category for manufacturers. Brands are prioritizing high-intent channels like Paid Search (PPC) and Social Advertising (LinkedIn) because of their direct, measurable attribution to sales outcomes.

- Owned Media (32%): SEO, email marketing, and technical content are the “trust engines” that keep a brand visible during long industrial sales cycles. Funds, once earmarked for physical booths and brochures, are being redirected into “owned” digital assets, as manufacturers prioritize lead generation campaigns and webinars to capture buyer intent during this critical, self-educated research phase. The shift in spending isn’t arbitrary; it’s a direct response to a radical change in buyer behavior. Modern B2B buyers now behave like digital-first consumers: on average, a manufacturing prospect will engage with 16 different digital touchpoints, from downloading CAD files and comparing spec sheets to watching demo videos, before they ever request a quote.

Offline & Event Marketing: The Strategic Lean (39% of Total Budget)

While offline spend has decreased, it hasn’t disappeared; it has evolved.

- Trade shows / Events (19.3%) still receive the most offline budget, but the type of spend has shifted. Marketers are moving away from “vanity” presence at massive national shows and instead shifting toward high-impact efficiency, with 59% of marketers planning more small-scale hosted events over the next 12 months to better prioritize core objectives like audience quality, ROI, and post-eventfollow-up. (Forrester’s 2025 State Of B2B Events Survey).

- Sponsorships (17%): Manufacturers are investing heavily in strategic partnerships and industrial association sponsorships to secure their authority and market leadership.

- Linear TV (16%): Surprising to some, television remains a vital channel for large-scale manufacturers looking to maintain brand visibility across the broader industrial ecosystem.

Top Manufacturing Marketing Trends for 2026

1. AI-Driven “Information-Native” Content

With AI agents (like Google’s AI Overviews) now intermediating 90% of B2B buying, manufacturers are shifting from “mass reach” to “information-native” content. This means structuring technical data, spec sheets, and case studies so they are easily “cited” by AI models. If an AI doesn’t find your data, your brand doesn’t exist in the buyer’s shortlist.

2. The “Return of Touch” & Targeted Events

Digital fatigue is real. In 2026, the most successful manufacturers are using their remaining event budget for “Sensory Branding.” This means interactive booth experiences, like VR factory tours or tactile product demos, at smaller, exclusive summits rather than giant, anonymous convention halls. Expect also more “Lunch & Learns” at local facilities and less “booth-duty” at sprawling convention centers.

3. The Strategic Shift to Targeted Inbound Marketing

Buyers are “invisible” until the very end of their journey. Targeted Inbound Marketing has become the industry’s lifeline. Manufacturers are no longer just posting blogs; they are building Dynamic Knowledge Hubs.

- The Goal: To be present at every digital touchpoint, from the first “how-to” search to the final “ROI calculator” comparison.

- The Context: Buyers are risk-averse. They want proof, not promises. Inbound strategies now focus on providing high-value technical documentation, 3D product configurators, and immersive VR factory tours that allow a procurement team to “verify” a vendor entirely online.

4. Account-Based Experience (ABX)

The trend has moved beyond simple Account-Based Marketing (ABM) to ABX. Using AI-powered predictive scoring, manufacturers can now identify which high-value accounts are currently in a “research phase” based on their digital footprint and serve them hyper-personalized content, like a custom-tailored video demo or a specific sustainability report, before the competitor even knows they are in the market.

5. First-Party Data Sovereignty

As third-party cookies disappear, manufacturers are investing heavily in their own data ecosystems. 11% to 15% of digital budgets are now dedicated to first-party data initiatives—collecting insights directly from their website visitors and CRM to fuel hyper-personalized email and LinkedIn campaigns.

The 2026 Reality Check: Why the Strategy Shifted

The manufacturers winning the market today are those who have stopped treating digital as a “support channel” and started treating it as their primary sales engine. This transition wasn’t just a choice; it was a necessary response to a triple threat of economic and demographic shifts:

- The Inflation Factor: The sheer logistics of physical presence have become a budget-killer. The cost of shipping heavy machinery, securing hotel blocks, and renting floor space has outpaced general inflation, causing the “cost-per-lead” at traditional trade shows to skyrocket to unsustainable levels.

- Millennial Dominance: The decision-maker profile has changed. Over 70% of B2B buyers are now Millennials or Gen Z, digital natives who have a near-zero tolerance for “salesy” pitches. They demand digital self-service, authentic technical content, and the ability to vet a vendor thoroughly before ever picking up the phone.

- The Mandate for Measurability: Under intensified pressure from the CFO, marketing teams are moving away from the “black box” of event brand awareness. By shifting funds to digital-heavy strategies, every dollar can now be traced directly to pipeline velocity and revenue attribution.

By balancing the “human touch” of targeted, small-scale events with a robust, inbound-heavy digital presence, these forward-thinking companies are achieving a level of ROI and resilience that traditional, analog-first methods simply can’t match.

To embrace digital manufacturer marketing, reach out to NNC Services. We have a proven track record helping manufacturing companies achieve their marketing and sales goals through the strategic implementation of SEO, PPC, content marketing, and beyond. We’d love to tell you more about bringing digital transformation to your business.